Anyone who is not aware of these investment concepts often gets confused between the general methods, tools, and strategies related to investment.

Often people ask about the difference between a SIP and mutual funds. In such cases, you just need to understand basic terminologies related to investment.

Nowadays the most profound way of making committed savings and making Investments is capital markets. In capital markets, there are two options available 1. Direct into equity market or money market 2. Investing via mutual funds.

It is not advisable to invest in equity with the general perception of your family and friends on the particular stock, one should invest money directly into the stock market only if you understand it, have the knowledge and make fundamental or even technical analysis of the market.

A mutual fund is a much reliable source of investment for someone who wants to do wealth creation but has no knowledge about the subject and leaves the judgment on the expert i.e. fund managers.

Yes, so basically mutual funds are pooling the money of investors and the fund manager invests that amount in two different assets as per the mutual fund category by their best knowledge.

If we broadly classify the mutual funds into different categories it would be e equity and debt. On one hand with equity consists of stocks of large-cap midcap and small-cap companies, the debt market includes the bonds of these corporate and even sovereign bonds by the government and are generally assessed based on the rating given to these bonds. Now, we have understood what mutual funds are. The next question you may ask is - what is the difference between SIP and mutual funds?

As explained above, a mutual fund is an Investment Avenue where we park our money to multiply. SIP is one of the tools for investing in mutual funds.

So basically there are two ways of investing money into a mutual fund:

- Lump-sum investment

- SIP (Systematic investment plan)

A lump sum investment is a one-time investment. In this, you invest your entire money in one go. For example, you have Rs 1,00,000 to invest in mutual funds. So lump-sum means you will invest the whole one lakh rupees at one go at a single point in time in mutual funds.

Whereas in a systematic investment plan you invest a particular amount of money not in lump-sum but regularly like weekly, monthly, quarterly, semi-annually, or annually. This method gained popularity as it comes with lots of benefits.

Why SIP is gaining popularity?

- No need for a constant check on the market: SIP mitigates the risk of losing a substantial portion when the market falls as it even out the volatility in the market.

- Rupee cost averaging: Since it gives you an option of periodic buying of units of a mutual fund. So when the market falls, more units are bought at a lower price and vice versa. So it helps in reducing the per-unit cost of the purchased units.

- Inculcate the habit of investing: SIP makes you financially disciplined and builds the habit of committed saving investing.

- option of starting with a small amount: the best thing about it is you can start investing even with a small amount of Rs 500. It's like a stepping stone to the world of investing.

Step-up SIP: this method recently gained popularity in which you can increase your SIP amount with a certain percentage periodically. For example; you are investing Rs 1,000 every month for a year. Step-up SIP gives you an option to increase your SIP amount by a certain percentage, say, 10% from next year. Thus, from next year SIP amount would be Rs 1,100 every month. This would give great growth to your invested value.

Let us understand this with an education goal example –

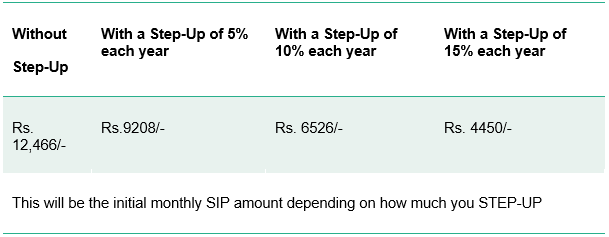

Imagine if the education costs Rs 15 lacs today, you will need to invest Rs. 12,466/- every month for 18 years to reach the goal with an assumption of 10% inflation and 12% return.

This required amount will reduce significantly if you increase the SIP amount each year.

To know your Step-up SIP amount try our Set-up SIP Calculator

So, now the main question arises which option is better: lump sum vs sip. The answer would be every option is good if it suits your needs and goals and to decide that you should try

Lump-sum Robo for lump-sum investments.

SIP Robo for SIP investments.

People often ask

- What is the meaning of SIP in a mutual fund?

- Which SIP plan is best in India?

- Is Daily Sip better than monthly SIP?

- Is SIP tax-free?

- What is the minimum return in SIP?

- Can Sip be withdrawn anytime?

Systematic Investment Plan (SIP) is a type of investment in mutual funds where people invest a fixed amount of money regularly for a short, medium or long period of time.

SIP is gaining popularity across India, some of the best SIP plans in India are

No, monthly SIP outweighs daily SIP in majority areas including returns, flexibility and options.

No, SIPs are not tax free, only those SIPs that fall under ELSS scheme or tax saving scheme of mutual funds are subject to exemptions as mentioned in section 80C.

On an average one can expect a return of 10-20% in long term SIPs, 14-17% in the mid term SIP and 5-10% in the short term SIP. But one should not be certain of these figure as mutual funds are subject to market risk.

Yes, you can stop the SIP anytime and withdraw the SIP amount as per your wish, one just have to fill the form to stop the SIP.

Conclusion

While selecting the method of investing or deciding the investment amount we must understand and know our financial goals, the current value, and the future cost of these goals keeping in mind our risk profile. If we are clear on the above part one will surely be able to create wealth for its goal and achieve them.