Edelweiss Large Cap Fund - Regular Plan - Growth option

Invest Now

Fund Manager: Co-Manage |

Equity: Large Cap |

NIFTY 100 TRI

NAV as on 27-01-2026

AUM as on

Rtn ( Since Inception )

13.62%

Inception Date

May 20, 2009

Expense Ratio

2.09%

Fund Status

Open Ended Scheme

Min. Investment

100

Min. Topup

100

Min. SIP Amount

100

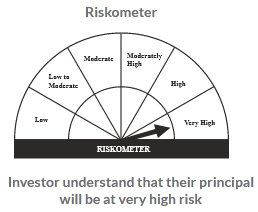

Risk Status

very high

Investment Objective : The investment objective is to seek to generate long-term capital appreciation from a portfolio predominantly consisting equity and equityrelated securities of the 100 largest corporate by market capitalisation listed in India. However, there is no assurance that the investment objective of the Scheme will be realized and the Scheme does not assure or guarantee any returns.