HDFC NIFTY 50 ETF - Growth Plan

Invest Now

Fund Manager: FM 1 - Mr. Abhishek Mor, FM 2 - Mr.Arun Agarwal |

ETFs |

NIFTY 50 TRI

NAV as on 16-01-2026

AUM as on

Rtn ( Since Inception )

14.06%

Inception Date

Dec 05, 2015

Expense Ratio

0.05%

Fund Status

Open Ended Scheme

Min. Investment

5,000

Min. Topup

1

Min. SIP Amount

500

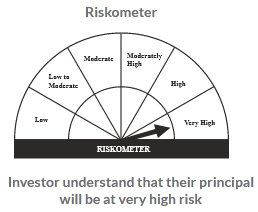

Risk Status

very high

Investment Objective : To generate returns that are commensurate with the performance of the NIFTY 50 Index, subject to tracking error.There is no assurance that the investment objective of the scheme will be achieved.