Nippon India Ultra Short Duration Fund- Growth Option

Invest Now

Fund Manager: Vivek Sharma |

Debt: Ultra Short Duration |

CRISIL Ultra Short Duration Debt A-I Index

4135.7806

-0.43

(-0.01 %)

NAV as on 10-12-2025

1,346.32 Cr

AUM as on

Fund House: Nippon India Mutual Fund

Rtn ( Since Inception )

6.09%

Inception Date

Dec 07, 2001

Expense Ratio

1.11%

Fund Status

Open Ended Scheme

Min. Investment

100

Min. Topup

100

Min. SIP Amount

100

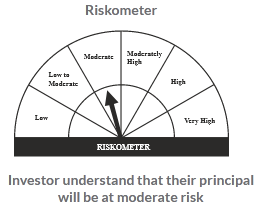

Risk Status

moderate

Investment Objective : The Scheme seeks to generate optimal returns consistent with moderate levels of risk and liquidity by investing in debt and money market instruments.