SBI-CONSUMPTION-OPPORTUNITIES-FUND-REGULAR-GROWTH

Invest Now

Fund Manager: Mr. Saurabh Pant, Mr. Pradeep Kesavan, Mr. Ashit Desai, |

Equity: Thematic-Consumption |

NIFTY India Consumption TRI

NAV as on 22-09-2025

AUM as on

Rtn ( Since Inception )

15.54%

Inception Date

Jul 14, 1999

Expense Ratio

1.97%

Fund Status

Open Ended Scheme

Min. Investment

5,000

Min. Topup

1,000

Min. SIP Amount

500

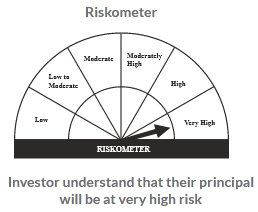

Risk Status

very high

Investment Objective : To provide the investor with the opportunity of long term capital appreciation by investing in a diversified portfolio of equity and equity related securities in Consumption space.

Fund Performance

3 and 6 Months returns are absolute

NAV Movement

Returns (%)

| 3 Mon | 6 Mon | 1 Yr | 3 Yrs | 5 Yrs | 10 Yrs | |

|---|---|---|---|---|---|---|

| Fund | 3.73 | 7.51 | -10.43 | 14.75 | 25.39 | 16.1 |

| Nifty India Consumption TRI | 8.0 | 16.45 | -1.52 | 16.6 | 21.87 | 15.36 |

| Equity: Thematic-Consumption | 6.13 | 13.33 | -5.67 | 15.7 | 22.04 | 15.28 |

| Rank within Category | 18 | 19 | 15 | 10 | 1 | 3 |

| Number of Funds within Category | 20 | 20 | 16 | 11 | 11 | 7 |

Peer Comparison

| Return (%) | ||||||

|---|---|---|---|---|---|---|

| Scheme Name | AUM (crore) |

Expense Ratio |

1 Yr | 3 Yrs | 5 Yrs | 10 Yrs |

| SBI Consumption Opportunities Fund - Regular - Growth | 317.38 | 1.97 | -10.43 | 14.75 | 25.39 | 16.1 |

| Kotak Consumption Fund - Regular plan - Growth Option | 148.52 | 2.08 | -1.29 | 0.0 | 0.0 | 0.0 |

| HSBC Consumption Fund - Regular Growth | 164.33 | 2.09 | -2.27 | 0.0 | 0.0 | 0.0 |

| Axis Consumption Fund Regular Plan - Growth | 409 | 1.86 | -3.03 | 0.0 | 0.0 | 0.0 |

| ICICI Prudential Bharat Consumption Fund - Growth Option | 326.04 | 1.99 | -3.93 | 17.82 | 22.04 | 0.0 |

| Sundaram Consumption Fund(Formerly Known as Sundaram Rural and Consumption Fund Regular Plan - Growth) | 159.92 | 2.18 | -4.35 | 15.52 | 20.61 | 14.92 |

| Aditya Birla Sun Life Consumption Fund-Growth Option | 632.23 | 1.83 | -4.43 | 14.78 | 21.82 | 15.56 |

| Tata India Consumer Fund-Regular Plan-Growth | 251.86 | 1.98 | -4.59 | 17.18 | 21.63 | 0.0 |

| Mirae Asset Great Consumer Fund - Regular Plan - Growth option | 455.25 | 1.83 | -4.74 | 17.14 | 23.09 | 16.66 |

| Canara Robeco Consumer Trends Fund - Regular Plan - Growth Option | 191.22 | 2.07 | -5.28 | 15.23 | 22.13 | 16.34 |

Yearly Performance (%)

Historical Returns (%)

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Fund | 5.32 | 2.39 | 53.1 | -1.97 | 0.13 | 13.86 | 35.57 | 13.86 | 29.92 | -3.12 |

| NIFTY India Consumption TRI | 8.98 | -1.32 | 46.7 | -1.07 | 0.55 | 20.51 | 20.82 | 8.53 | 27.96 | 10.96 |

Returns Calculator

Growth of 10000 In SIP (Fund vs Benchmark)

- Daily

- Weekly

- FortNightly

- Monthly

- Quarterly

Growth of 10000 In LUMPSUM (Fund vs Benchmark)

Rolling Returns

- 1 Month

- 1 Year

- 3 Years

- 5 Years

- 10 Years

- 15 Years

Rolling returns are the annualized returns of the scheme taken for a specified period (rolling returns period) on every day/week/month and taken till the last day of the duration. In this chart we are showing the annualized returns over the rolling returns period on every day from the start date and comparing it with the benchmark. Rolling returns is the best measure of a fund's performance. Trailing returns have a recency bias and point to point returns are specific to the period in consideration. Rolling returns, on the other hand, measures the fund's absolute and relative performance across all timescales, without bias.

Fund Multiplier

Riskometer

Asset Allocation

Top 10 Holdings

| Company | Holdings (%) |

|---|---|

| BHARTI AIRTEL LIMITED EQ NEW FV RS 5/- | 5.89 |

| JUBILANT FOODWORKS LIMITED EQ NEW FV RS. 2/- | 4.72 |

| BRITANNIA INDUSTRIES LIMITED EQ NEW FV RS 1 | 4.48 |

| HINDUSTAN UNILEVER LIMITED EQ F.V. RS 1 | 4.19 |

| ASIAN PAINTS LIMITED EQ NEW FV Re. 1/- | 4.04 |

| MAHINDRA AND MAHINDRA LIMITED EQ NEW F.V. RS.5 | 3.98 |

| BERGER PAINTS INDIA LIMITED EQ NEW FV RE. 1/- | 3.95 |

| ITC LIMITED EQ NEW FV RE.1/- | 3.82 |

| GANESHA ECOSPHERE LIMITED EQ | 3.8 |

| AVENUE SUPERMARTS LIMITED EQ | 3.78 |

| UNITED BREWERIES LIMITED EQ NEW FV RE.1/- | 3.73 |

| EICHER MOTORS LIMITED EQ NEW FV RE. 1/- | 3.29 |

| COLGATE-PALMOLIVE (INDIA) LIMITED EQ NEW FV RS.1/- | 3.12 |

| PAGE INDUSTRIES LIMITED EQ NEW FV RS.10/- | 2.82 |

| EIH LIMITED EQ NEW FV RS.2/- | 2.74 |

| TREPS | 2.62 |

| TVS MOTOR COMPANY LIMITED EQ FV RE.1/- | 2.59 |

| MARUTI SUZUKI INDIA LIMITED EQ | 2.5 |

| VOLTAS LIMITED EQ NEW FV RE.1/- | 2.19 |

| BRAINBEES SOLUTIONS PRIVATE LIMITED EQ NEW FV Rs. 2/- | 1.94 |

| DOMS INDUSTRIES PRIVATE LIMITED EQ | 1.91 |

| CAMPUS ACTIVEWEAR LIMITED EQ NEW FV RS.5/- | 1.79 |

| TRENT LIMITED EQ NEW FV Re. 1/- | 1.67 |

| WHIRLPOOL OF INDIA LIMITED EQ | 1.58 |

| FSN E-COMMERCE VENTURES LIMITED EQ NEW FV RE.1/- | 1.52 |

| FLAIR WRITING INDUSTRIES LIMITED EQ NEW FV RS.5/- | 1.51 |

| SHEELA FOAM LIMITED EQ NEW FV RS. 5/- | 1.37 |

| HAWKINS COOKERS LIMITED EQ | 1.37 |

| GODREJ CONSUMER PRODUCTS LIMITED EQ NEW FV RE.1/- | 1.29 |

| WESTLIFE DEVELOPMENT LIMITED EQ NEW FV RS. 2/- | 1.27 |

| TITAN COMPANY LIMITED EQ NEW Re.1/- | 1.14 |

| APOLLO TYRES LIMITED EQ RE.1/- | 1.09 |

| BLUE STAR LIMITED EQ NEW FV RS.2/- | 1.04 |

| VISHAL MEGA MART PRIVATE LIMITED EQ | 1.04 |

| V-GUARD INDUSTRIES LIMITED EQ NEW FV Re. 1/- | 0.93 |

| Net Receivable / Payable | 0.91 |

| EMAMI LIMITED EQ NEW F.V. RE.1/- | 0.9 |

| Aditya Infotech Limited | 0.88 |

| DODLA DAIRY LIMITED EQ | 0.86 |

| Varun Beverages Ltd | 0.81 |

| HATSUN AGRO PRODUCT LTD EQ NEW FV Re.1/- | 0.77 |

| Stanley Lifestyles Limited | 0.72 |

| GO FASHION (INDIA) LIMITED EQ | 0.64 |

| SULA VINEYARDS LIMITED EQ NEW FV RS.2/- | 0.63 |

| Margin amount for Derivative positions | 0.63 |

| AVANTI FEEDS LIMITED EQ NEW FV RE. 1/- | 0.61 |

| RELAXO FOOTWEARS LIMITED EQ NEW FV RE. 1/- | 0.44 |

| BRIGADE HOTEL VENTURES LIMITED EQ | 0.37 |

| 182 DAY T-BILL 20.11.25 | 0.09 |

| TVS Motor Company Ltd. | 0.03 |

Related Funds in this Category

Sector Allocation (%)

Equity Holdings

| Company | Sector | Holdings (%) |

|---|---|---|

| BHARTI AIRTEL LIMITED EQ NEW FV RS 5/- | Telecom - Services | 5.89 |

| JUBILANT FOODWORKS LIMITED EQ NEW FV RS. 2/- | Leisure Services | 4.72 |

| BRITANNIA INDUSTRIES LIMITED EQ NEW FV RS 1 | Food Products | 4.48 |

| HINDUSTAN UNILEVER LIMITED EQ F.V. RS 1 | Diversified FMCG | 4.19 |

| ASIAN PAINTS LIMITED EQ NEW FV Re. 1/- | Consumer Durables | 4.04 |

| MAHINDRA AND MAHINDRA LIMITED EQ NEW F.V. RS.5 | Automobiles | 3.98 |

| BERGER PAINTS INDIA LIMITED EQ NEW FV RE. 1/- | Consumer Durables | 3.95 |

| ITC LIMITED EQ NEW FV RE.1/- | Diversified FMCG | 3.82 |

| GANESHA ECOSPHERE LIMITED EQ | Textiles & Apparels | 3.8 |

| AVENUE SUPERMARTS LIMITED EQ | Retailing | 3.78 |

| UNITED BREWERIES LIMITED EQ NEW FV RE.1/- | Beverages | 3.73 |

| EICHER MOTORS LIMITED EQ NEW FV RE. 1/- | Automobiles | 3.29 |

| COLGATE-PALMOLIVE (INDIA) LIMITED EQ NEW FV RS.1/- | Personal Products | 3.12 |

| PAGE INDUSTRIES LIMITED EQ NEW FV RS.10/- | Textiles & Apparels | 2.82 |

| EIH LIMITED EQ NEW FV RS.2/- | Leisure Services | 2.74 |

| TREPS | 2.62 | |

| TVS MOTOR COMPANY LIMITED EQ FV RE.1/- | Automobiles | 2.59 |

| MARUTI SUZUKI INDIA LIMITED EQ | Automobiles | 2.5 |

| VOLTAS LIMITED EQ NEW FV RE.1/- | Consumer Durables | 2.19 |

| BRAINBEES SOLUTIONS PRIVATE LIMITED EQ NEW FV Rs. 2/- | Retailing | 1.94 |

| DOMS INDUSTRIES PRIVATE LIMITED EQ | Household Products | 1.91 |

| CAMPUS ACTIVEWEAR LIMITED EQ NEW FV RS.5/- | Consumer Durables | 1.79 |

| TRENT LIMITED EQ NEW FV Re. 1/- | Retailing | 1.67 |

| WHIRLPOOL OF INDIA LIMITED EQ | Consumer Durables | 1.58 |

| FSN E-COMMERCE VENTURES LIMITED EQ NEW FV RE.1/- | Retailing | 1.52 |

| FLAIR WRITING INDUSTRIES LIMITED EQ NEW FV RS.5/- | Household Products | 1.51 |

| SHEELA FOAM LIMITED EQ NEW FV RS. 5/- | Consumer Durables | 1.37 |

| HAWKINS COOKERS LIMITED EQ | Consumer Durables | 1.37 |

| GODREJ CONSUMER PRODUCTS LIMITED EQ NEW FV RE.1/- | Personal Products | 1.29 |

| WESTLIFE DEVELOPMENT LIMITED EQ NEW FV RS. 2/- | Leisure Services | 1.27 |

| TITAN COMPANY LIMITED EQ NEW Re.1/- | Consumer Durables | 1.14 |

| APOLLO TYRES LIMITED EQ RE.1/- | Auto Components | 1.09 |

| BLUE STAR LIMITED EQ NEW FV RS.2/- | Consumer Durables | 1.04 |

| VISHAL MEGA MART PRIVATE LIMITED EQ | Retailing | 1.04 |

| V-GUARD INDUSTRIES LIMITED EQ NEW FV Re. 1/- | Consumer Durables | 0.93 |

| Net Receivable / Payable | 0.91 | |

| EMAMI LIMITED EQ NEW F.V. RE.1/- | Personal Products | 0.9 |

| Aditya Infotech Limited | Industrial Manufacturing | 0.88 |

| DODLA DAIRY LIMITED EQ | Food Products | 0.86 |

| Varun Beverages Ltd | Beverages | 0.81 |

| HATSUN AGRO PRODUCT LTD EQ NEW FV Re.1/- | Food Products | 0.77 |

| Stanley Lifestyles Limited | Consumer Durables | 0.72 |

| GO FASHION (INDIA) LIMITED EQ | Retailing | 0.64 |

| SULA VINEYARDS LIMITED EQ NEW FV RS.2/- | Beverages | 0.63 |

| Margin amount for Derivative positions | 0.63 | |

| AVANTI FEEDS LIMITED EQ NEW FV RE. 1/- | Food Products | 0.61 |

| RELAXO FOOTWEARS LIMITED EQ NEW FV RE. 1/- | Consumer Durables | 0.44 |

| BRIGADE HOTEL VENTURES LIMITED EQ | Leisure Services | 0.37 |

| 182 DAY T-BILL 20.11.25 | undefined | 0.09 |

| TVS Motor Company Ltd. | undefined | 0.03 |

Market Cap Distribution

Portfolio Behavior

| Volatility | 10.64 |

| Sharp Ratio | 0.74 |

| Alpha | 1.07 |

| Beta | 0.86 |

| Standard Deviation | - |

| Portfolio Turnover | 35 |

Extreme Performance

| Time Frame | Period | Fund (%) |

Benchmark (%) |

|---|---|---|---|

| Best Month | 30-05-2014 | 11.64 | 8.11 |

| Worst Month | 31-01-2011 | -10.46 | -10.23 |

| Best Quarter | 30-06-2014 | 20.12 | 14.03 |

| Worst Quarter | 30-09-2011 | -9.40 | -12.11 |

| Best Year | 31-12-2014 | 57.64 | 32.91 |

| Worst Year | 30-12-2011 | -22.29 | -23.81 |