Fixed deposits have been part of almost all Indian family’s investment portfolio simply because it offers assured or fixed interest for the investment tenure along with safety. However, over the past few years, debt mutual funds are finding a place in the portfolio of those investors who understand debt mutual funds well.

Debt funds are a type of mutual fund that generates returns by investing in various kinds of deposits, corporate bonds, fixed income securities, debentures and Government securities etc. While fixed deposit returns are assured, debt fund returns vary because the instruments or bonds in the debt mutual fund portfolio are tradable and prices of these instruments are linked to the interest rate movement as declared by RBI from time to time.

Suggested reading: What are debt mutual funds

Debt funds provide a wide range of solutions to investors with different risk profiles, investment objectives and tenures.

However, there still remain few misconceptions like – 1) Fixed deposits always give better returns over debt funds 2) Debt funds are risky 3) Debt funds are for retired people and 4) All debt funds are same.

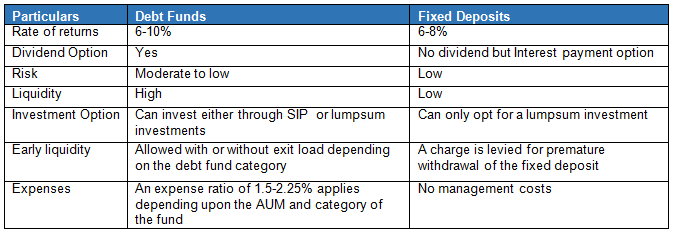

Let us now compare debt funds with fixed deposits to clear some myths and also to find out the advantages of debt mutual funds over fixed deposits –

Difference between debt mutual funds and fixed deposits

See the table below which may help you decide which investment is suitable for you.

While fixed deposits offer pre-set interest rates based on the tenure chosen, debt fund returns are solely dependent on the interest rate scenario. Historically, debt funds have given higher returns over fixed deposits. Debt and money market instruments like bonds, CP/CDs etc. can give higher returns than risk free investments. In addition to higher yields, since these papers are traded in the market, their prices appreciate with fall in interest rates or improvement in the credit rating. On the flip side, however, the prices of these papers may fall if the conditions are reversed.

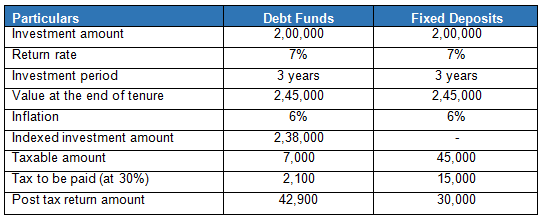

Taxation of debt mutual funds versus fixed deposits

In case of debt funds, short term capital gains (holding period less than 3 years) are added to income and taxed at the tax slab applicable to the investor. Long term capital gains (holding period of more than 3 years) are taxed at 20% after allowing the indexation benefits.

On the other hand, the fixed deposit returns are added to investor’s income and taxed according to the applicable tax slabs. Moreover, tax is deducted at source (TDS) beyond the threshold limit, on the interest paid on fixed deposits. Whereas,there is no TDS on the profits on debt funds (for resident individual investors).

Inflation adjusted returns of debt mutual funds versus fixed deposits

See the table below to understand it better.

As you may know that inflation puts a damper on your earnings, but debt mutual funds have the potential to keep pace with the inflation. If you see the above example, even if we assume that returns are same for debt mutual funds and fixed deposits, the post-tax returns are higher in case of debt mutual funds as indexation is allowed in case of long term capital gains.

Please see a live example of the above comparison – comparison of fixed deposit versus debt funds

As we can see there are quite a few advantages of debt mutual funds over fixed deposits. Debt Mutual funds can be good alternative to fixed deposits provided you can select the right debt fund based on the tenure of your investment and your risk profile.

You may also like to read:

How to select best debt mutual funds for your investment needs