ARTI ARORA CFP CM | HEAD FINANCIAL PLANNER

In very layman terms, small cap funds are those funds that invest in small cap stocks. A more precise definition would be that those funds that invest in all companies except the top 250 companies in terms of market capitalization are termed as small cap funds.

As per the AMFI definition of small cap funds, at least 65% investment of the small cap funds is done in small cap stocks.

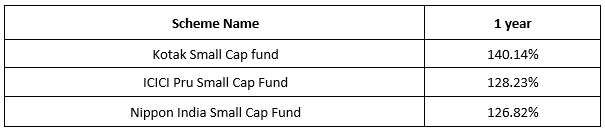

The last one year has been a year of magnificent returns from the small cap funds with the top performing funds delivering 150-200% annualized returns. The table below shows the last one year’s returns from some of the small cap funds –

The bull-run and the rally up in these funds is quite clear from the illustration above.

But should this be the deciding factor for one to start investing in these funds or should one carefully analyze other important factors too?

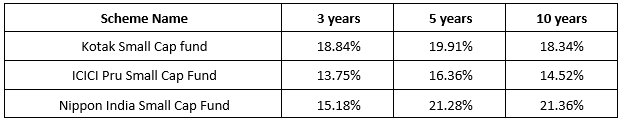

Let us discuss the case of small cap mutual funds in greater detail and take a look at returns from the same funds as above over longish time frames –

When we analyze returns over 3 years, 5 years and 10 years, the picture completely changes and that is not to say that these returns are not lucrative enough. They sure are but the last 1 year has been an exception of sorts and may not be a sustained rally in years to come.

Just as the expected growth in the small cap funds is above average, so is the associated risk with these funds and any overall market fall can drive the returns from these funds southwards rather sharply.

If your risk profile is aggressive, if your risk tolerance meter puts you in high category, you sure can invest in small cap funds provided your investment time horizon is at least 7-10 years. The intermittent volatility and the dip in returns in the shorter time frame could be very sharp and so these small cap funds are surely not for the faint hearted.

On a more generic level, an investor can consider investing about 5-15% of their investment portfolio in these small cap funds preferably through the SIP / STP route to even out risk. This investment should be only for long term as specified above. Any investment for a shorter horizon will be punting which can adversely affect the overall portfolio returns.

When selecting the fund that you should invest in, following are the important parameters to consider –

- Fund performance & consistency

- Peer group comparison

- Fund Cost / Expense Ratio

The fund size or AUM is another factor which may not be very critical but is still an important one.

Having analyzed the funds on the above parameters, one can take an informed decision and invest in the right fund. Small cap funds have the growth potential to by-pass other fund categories but at the same time, the risk associated with investment in small cap funds is also considerably high and thus it is advisable to take a measured decision when investing in the small cap fund category.

Linking your investments to your financial goals is a great start point and for the goals due in 7-10 years or more, small cap funds can always find some space, albeit a tighter one.