From Director’s Desk | Anirudh Dar

One of the first things we need to know when it comes to differentiating between a mutual fund and a ULIP is the nature of the product itself. While both are market linked, a ULIP is an insurance product that is very often mis-sold as an out and out equity investment. Now while this may be true in parts, the biggest challenge while taking a ULIP is that one must be prepared to remain locked-into it for a minimum of 60 months. A ULIP offers no exit options before the end of that period, unless the life insured passes away.

Let us understand these two products in detail so you would end up making better financial decisions while choosing one or the other for reasons best suited to your personal financial aspirations and future needs.

What is a mutual fund?

In the most layman terms, a mutual fund is a combination of stocks, bonds and other underlying assets put together to create specific fund portfolio across multiple clients who invest in them and have a common investment objective. This is possibly the easiest, most transparent, flexible and cost-effective method to enter into the universe of capital market investments. The minimum investment in most schemes could be as low as Rs 500/- and one can exit these at any point in time, with or without a small charge.

What is a ULIP?

ULIP stands for Unit Linked Insurance Plan and is offered by insurance companies only. These kinds of investments have an in-built insurance cover that is usually 10 times of the annual premium that is paid by the owner of the policy, also called the life insured. As mentioned earlier, these are highly restrictive investments, meaning that one must adhere to a minimum premium payment period as decided at the inception of the policy period. There are penalties if one stops paying in the interim and money is locked-in for a minimum of 60 months.

What is our take on this?

What most advisors will never discuss is the fundamental difference between ‘insuring your life’ and ‘growing your investments’. By their very definitions, these are two separate things and must be dealt with separately. Investments and Insurance must not be mixed-up, especially when it comes to investing in ULIPs for the primary purpose of growing your wealth. The primary purpose of insurance should be met with an insurance product and it is recommended that one opt for a pure term plan to secure one’s life. For your investment purposes, it is best to invest in mutual fund investment plans.

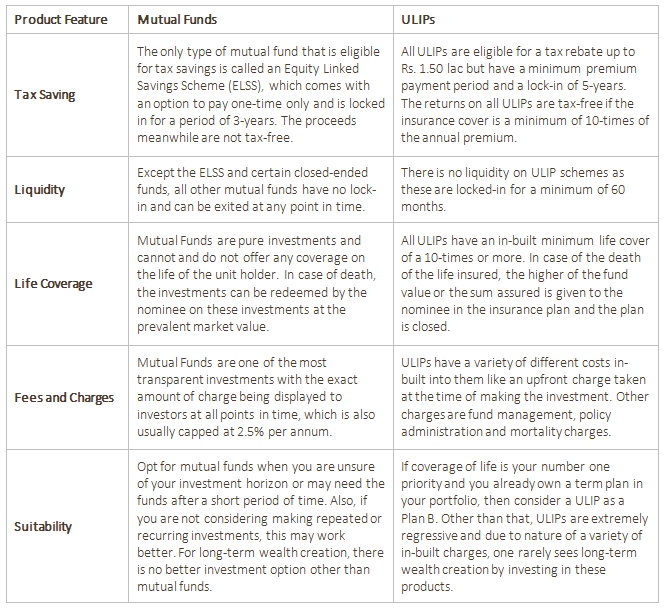

Now let us look at individual product features and see how they stack up against one another.

In conclusion:

There will always be pros and cons while comparing two types of products and here too, we have attempted to that, but given that is an unequal comparison, in order to find a clear winner, one needs to be clear on their individual goals and preferences. For example, if the primary goal is to have a life cover, then a mutual fund cannot be the preferred option. On the contrary, if you want constant liquidity and do not intend to be tied down to a product lock-in, then the only option for you would be a mutual fund.

It is best advised to consult with your financial planners or advisers and take informed decisions when it comes to investing in financial products.