From Director's Desk | Anirudh Dar

The dictionary defines the word hybrid as a mixture of two different things, resulting in something that has a little bit of both. Hence hybrid funds are those types of mutual funds that invest in multiple asset classes within one fund. Mostly, they are a combination of equity and debt assets, and sometimes they also include gold, commodities or even real estate.

What are the main aspects of a hybrid fund? Hybrid funds fulfil many investment conditions in one fund, with the main ones being (a) asset allocation, (b) correlation, and (c) diversification. Asset Allocation is the process of distributing the funds into various asset classes. Correlation is the co-movement of returns of the underlying assets (such as between equity and gold) and diversification is to have more than one asset in a portfolio (such as holding equity and debt in one fund). Consider this: if all your money is in one large cap fund which would inherently have a 100% equity composition, all the underlying assets in that fund would demonstrate a very high level corelation (of risk and returns), both on the upside and the downside. Whereas, in a hybrid fund which would have investments in various asset classes, the corelation would be lower hence returns would be more stable and the fund itself would be less volatile. In general, the portfolio risk can be reduced by combining assets that have a low correlation and that is precisely what hybrid funds attempt to do - diversify the investments within multiple asset classes to try and achieve maximum returns at minimum possible risk.

How do hybrid funds work? Given that all hybrid funds predominantly invest in two asset classes, equity and debt, the potential for generatinghigher returns and creating wealth comes from the equity portion of the holdings. On the other hand, the debt holdings in the portfolio include interest-bearing instruments that generate regular income. Debt is considered a lower risk asset class as compared to equity. Additionally, equity and debt asset classes have low correlation, and hence combining them reduces the portfolio risk. Hybrid mutual funds essentially try to offer the best of both the asset classes in a single product. Their equity portion generate returns when the equity markets are doing well, and the debt portion provides a cushion for the times that the market is under-performing.

How many types of hybrid funds are there?

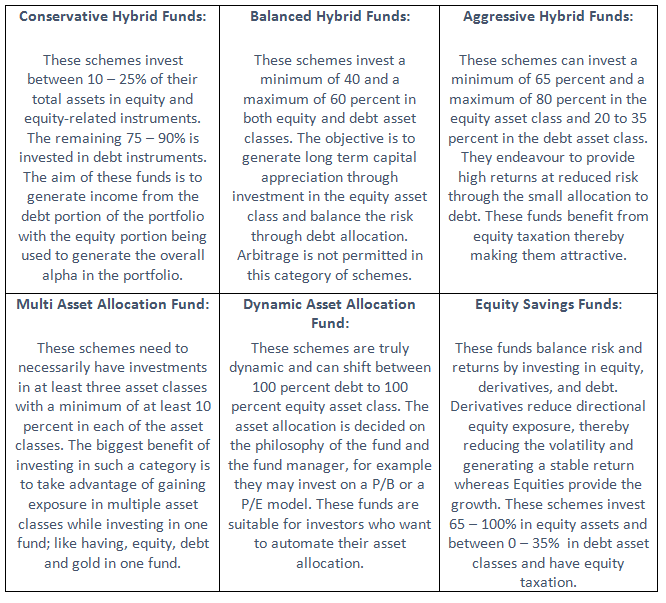

Broadly speaking, there are 6 types of hybrid funds, each different from the other one:

Who should invest in hybrid funds?

There is never a good answer to which client profile type can invest in which type of a fund because that will always come down to the individual risk appetite and the duration of holding a particular fund. But hybrid funds have a slightly easier recommendation.

If you are a first time investor and are unclear on what will work for you and what wont, you may be better off investing in hybrid funds as these will offer an entry into the equity markets without taking the actual downside risk of being in equities. These types of funds are also suitable for retirees who are looking for regular income and efficient taxation.

However, as always, you need to take the advice of your financial advisor before making investments in the capital markets.

Happy Investing!