The secret of wealth creation is the power of compounding. Power of compounding is one of the most fundamental concepts in investing and it is fairly simple to grasp. Yet, most investors do not realize the power which compounding has on your investments. To understand compounding, we need to go back to our old school days and recall two mathematics concepts we all learnt when we were 13 or 14 years old. These two concepts are simple interest and compound interest.

Simple interest is the interest rate on loan or deposit. Suppose you invest Rs 1 lakh for three years at an interest rate of 8%. After one year you will get Rs 8,000 (8% of Rs 1 lakh) as interest. The principal amount remains invested. At the end of the second year, you will again be paid Rs 8,000 as interest. At the end of third year, you will get back your principal amount of Rs 1 lakh and Rs 8,000 as interest for the third year. The total interest received by you over the three year term of the investment will be Rs 24,000.

In compound interest, the interest amount is added to the principal amount at the end of each period, interest is paid on the total amount. For example, you invest Rs 1 lakh for three years at an interest rate of 8% with annual compounding. At the end of the 1 year, you will accrue interest of Rs 8,000 (8% of Rs 1 lakh). The accrued interest will be added to principal amount and the total amount of Rs 108,000 will now earn interest.

At the rate of 8% per annum, in the second year you will accrue an interest of Rs 8,640. This accrued interest will now be added to the principal amount of Rs 1 lakh and interest accrued in first year (Rs 8,000). The total invested amount now is Rs 1 lakh + Rs 8,000 (first year interest) + Rs 8,640 (second year interest) = Rs 116,640, which will then earn interest at the rate of 8% in the third year. The interest earned in the third year will be Rs 9,331.

At the end of the third year you will get the principal amount of Rs 1 lakh and the total interest accrued over three years. The total accrued interest will be Rs 8,000 (first year interest) + Rs 8,640 (second year interest) + Rs 9,331 (third year interest) = Rs 25,971.

Compare the total interest over three years in the simple interest method versus the compound interest method. You can see that you get almost Rs 2,000 more interest in the compound interest method versus simple interest method. Why did you make more money using the compound interest method? You made more money because, the interest instead of being paid out to you remain invested and earned more interest.

You can check this Compounding Calculator

Compounding is basically interest earned on interest or profit earned on profit. Money which remains invested compounds in value. Profits grow the investment value and you earn even more profits as the investment value increases over time. Over a long investment horizon the original investment amount is only a small percentage of the total investment value; profits on profits constitute the major part of the investment value.

All of us work for money but compounding makes money work for you. This is how investors create wealth. Though we explained the concept of compounding using interest rates, compounding does not only takes place in fixed income or debt investments. The effect of compounding can be seen across asset classes. In fact, the most powerful impact of compounding is seen in stocks or equity mutual funds.

One of the best examples of wealth creation through the power of compounding over long investment period is the returns since inception of Reliance Growth Fund. By investing in Reliance Growth Fund at its inception (New Fund Offer), investors would have been able to grow their wealth more than 100 times over the past 23 years. If you had invested just Rs 10,000 in Reliance Growth Fund at the time of the scheme New Fund Offer, your wealth today in that scheme would be more than Rs 10.35 lakhs!

What is source of the tremendous power of compounding? It is time. The longer you remain invested, more interest will be earned on interest or more profits will be earned on profits. Going back to our simple interest versus compound interest example, if you invested Rs 1 lakh at an interest rate of 8% per annum for a period of 10 years, using the simple interest method the total interest earned in 10 years will be Rs 80,000. Using the compound interest method, the total interest earned in 10 years will be around Rs 116,000. Recall that the difference between compound and simple interest was Rs 2,000 over a 3 period. If you simply extrapolated this difference, then over a 10 year period, you would have expected a difference of around Rs 7,000, but the actual difference is around Rs 36,000. This shows how the power of compounding grows over time.

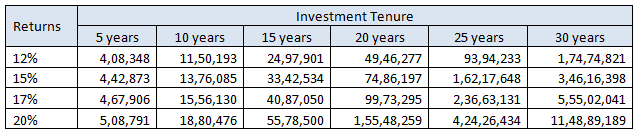

Mutual Fund Systematic Investment Plans (SIP) unleashes the awesome power of compounding from small savings made regularly. The table below presents a scenario analysis of the future corpus value built over various time periods at different rate of return, with a monthly SIP amount of Rs. 5000/-

Let us now discuss a real example - A monthly SIP of Rs 5,000 in Reliance Growth Fund over the last 23 years (since inception) would have created a corpus of around Rs 3.30 Crores against an investment of Rs 14.00 Lakhs only! Please check - SIP return of Reliance Growth Fund

Conclusion

In this article we discussed awesome power of compounding. We also discussed the power of compounding grows over time. Therefore, it is very important to remain invested for a long period of time if you want to create wealth. When you are young, time is on your side and therefore, one should start investing from a young age. Remaining invested for long periods of time, especially in equity, calls for patience and fortitude because equity is a volatile, but in the end investors will get richly rewarded.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.