Nowadays, debt mutual funds are becoming one of the prominent choices among investors who strive for low-risk options, an alternative to bank fixed deposits. The primary benefit of these funds is the ability to make profits along with capital appreciation.

Another advantage of debt funds is that it provides you a cushion against inflation risk and this concept is popularly known as indexation benefit. Indexation gives you an up hand in the calculation as it allows you to inflate your purchase price. So basically, when your fund is sold on a later date, the indexation benefit will allow you to inflate your purchase price on that date to show the true value of your purchase and you may end up paying lower taxes through the difference between your purchase and sale price. Thus, we can do the calculation for the debt fund category.

Tax Liability on Debt Mutual Fund Earnings:

Tax liability on dividend returns of these funds is not levied on investors directly. Instead, they are paid by the AMC themselves. The DDT (dividend distribution tax) is 29.12% on debt mutual funds.

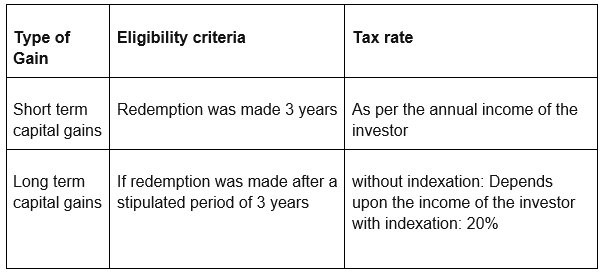

However, profits made through the purchase and sale of NAV units from these mutual funds, are chargeable for tax purposes. If the debt fund is redeemed before the stipulated period i.e. 3 years, then profit earned on the redemption of the fund is taxable as capital gains by the annual income of the investor. Therefore, STCG varies from 10%-37% depending upon the tax slab one falls under:

However if the debt fund is held for more than 3 years, the gain on the mutual fund is considered as LTCG (long term capital gains and the tax) which is levied in two ways:

- With indexation benefits: 20%

- Without indexation benefits: by the annual income of the investor

Tax on Capital Gains on debt mutual funds

However, in case an investor incurs capital loss during the redemption of units of debt mutual funds, exemption from taxability from these funds is prevailed for the respective financial year.

What is Indexation?

Let’s understand indexation in mutual funds in detail. It is the process by which you can account for inflation in your debt fund gains so that you pay fewer taxes.

We all know the value of the rupee will keep on lowering over some time. For eg if the value for $1 was around Rs 67 a year ago, now the value for $1 is around Rs 76. This 13.4% jump from 67 to 76 is an embodiment of inflation and how it has lowered our purchasing power.

Therefore, the Indexation benefit gives you returns over and above the inflation. If you inflate your purchase price according to the ongoing inflation rate, the gap between your selling and purchasing price will reduce and thus, lowering your taxes.

The actual value of profits can be determined by using the following indexation formula-

Value after indexation = original amount * (CII of the current year/CII of the year of purchase)

Where, CII: Cost Inflation Index

Let us demonstrate this with an example. Mr. X had invested Rs. 1 Lakh in a debt mutual fund in 2016. After 4 years, he decides to redeem his investment at Rs. 1.8 Lakh in 2020, thereby realizing a profit of Rs. 80,000.

However, this income is subjected to LTCG tax on debt funds.

If adjustments to avail indexation are not made, we can assume that a 10% tax is deductible, as per the total annual income of the investor. In these circumstances, the total tax payable would amount to –

Tax = tax rate * total profit = 10/100* 80,000 = Rs. 8,000

Therefore, an amount of Rs. 8,000 would be deducted from the total profits of the investor, leaving the investor with Rs. 72,000.

The situation is different if the persisting inflation rate in the country is taken into account. For say, in 2016, the CII of India was 240. In 2020, the value increased to 280.

Thereby, the nominal value to realize the investment amount can be determined by the indexation formula –

Inflation-indexed worth = 1,00,000 * (280/240) = Rs. 1,16,667.

Therefore, total gains realized = Redemption Value-Indexed Cost Rs (1,80,000-1,16,667)= Rs 63,333

This value is subjected to a tax deduction of 20% of its value.

Tax payable = 20/100 * 63,333 = Rs. 12,667

Total realisable profit= Redemption value-Tax payable

Rs (80,000-12,666.67) = Rs 67,333.33

As it is evident in this indexation calculation for debt funds, that indexation adjusted tax rate gives a profit of Rs 67,333 while without indexation, the profit of Rs 72,000 is incurred.

From the above example, it can be observed that, if the same person was in a higher income tax bracket and would be attracting income tax of say 15-20%, the profit he would earn from his debt fund without indexation can vary and it might or might not be lower than the indexed profit. Hence it completely depends on which income tax bracket you fall under.

Conclusion

With due diligence of indexation benefit calculation and checking which way suits you best, one must decide. It depends on numerous factors, one of them being your income level and investor’s tax bracket.

Adjustments for indexation cannot be availed in conventional savings schemes, such as fixed deposits. By comparing the total tax liability and profits under both these situations, one can easily decide under which method you want to pay your taxes to maximize the total returns earned.

People often ask

- How is debt fund indexation calculated?

- Are mutual funds taxed when withdrawn?

- Can Debt Funds give negative returns?

- Are all mutual funds tax exempt?

To calculate debt fund indexation you need to multiply the purchase price with the current year CII and divide it by the CII of the year on which the purchase was made.

Yes, mutual funds are taxed when withdrawn as per the set percentage by the government and laws.

Yes, debt funds can give negative returns, when there is an upward increase in interest rate then the long-term debt funds can give negative returns.

No, only some mutual funds are tax-exempt for example ELSS is a tax saving mutual fund.