Many people use Exchange Traded Funds and index funds synonymously. Purely from the standpoint of investment objectives, index funds and exchange-traded funds (ETFs) are very much the same.

What is an ETF?

The financial resources of many entities are combined by exchange traded funds and used to buy different tradable monetary assets, such as shares, debt instruments, such as bonds and derivatives. The majority of ETFs are registered with India's Securities and Exchange Board (SEBI). It is an attractive choice for investors with minimal stock market experience.

How do Exchange Traded Funds (ETFs) Work?

ETFs share the distinctive characteristics of shares and mutual funds. They are normally traded on the stock market in the form of shares produced by production blocks. ETF funds are listed on all major stock exchanges and can be purchased and sold during the equity trading period as needed.

The adjustments in the share price of an ETF are contingent on the cost of the underlying assets in the resource pool. Where the price of one or more assets increases, the ETF's share price increases proportionately, and vice versa.

The dividend value earned by ETF shareholders depends on the success and asset management of the ETF business concerned.

As per company standards, they can be actively or passively controlled. Actively controlled ETFs are managed by a portfolio manager after carefully analyzing the conditions of the stock market and undertaking a measured risk by investing in high-potential businesses. On the other hand, passively managed ETFs follow the patterns of particular market indices, investing only in those companies listed on the rising graphs. Instead of opting for mutual funds or a company's shares, there are many benefits of investing in an ETF.

What is an Index Fund?

An index fund is a type of mutual fund or exchange-traded fund (ETF) with a portfolio designed to match or track the components of an index of the financial market, such as the Standard & Poor's 500 Index (S&P 500). It is said that the index mutual fund offers wide market exposure, low operating expenses and low turnover in the portfolio. Whatever the state of the markets, these funds follow their benchmark index.

Index funds, such as individual retirement accounts (IRAs) and 401(k) accounts, are commonly considered suitable core portfolio assets for retirement accounts. Legendary investor Warren Buffett has proposed index funds for the later years of life as a haven for investments. Instead of seeking out individual investment stocks, he said, it makes more sense for the average investor to purchase all of the S&P 500 companies at the low cost provided by an index fund.

ETF and Index Funds Similarities

- Exchange-Traded Funds (ETFs) like Index Funds invest in a basket of stocks that replicate the index.

- Like Index Funds, Exchange Traded Funds (ETFs) are passively managed and aim to track the index.

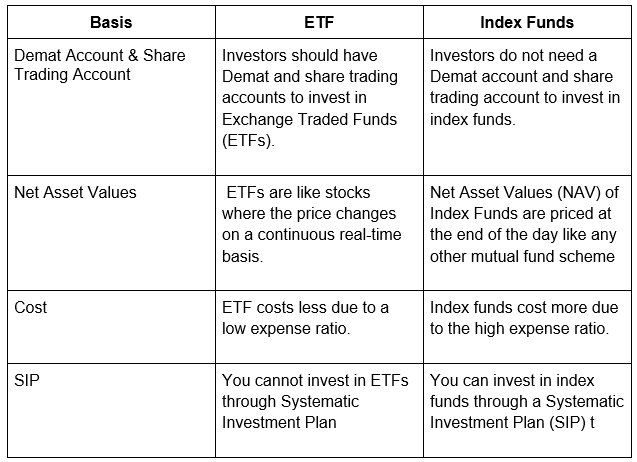

While there are similarities between the two types of funds, there are differences between the two which investors should clearly understand.

ETF vs Index Funds

People Often Ask

- Are ETFs better than index funds?

- Are index funds safer than ETFs?

- What is the best index fund to invest in 2020?

- What is the downside of ETFs?

If you are looking for flexibility then ETFs are better than Index funds, but ETFs are close-ended funds and index funds are open-ended funds. So, it entirely depends on your need.

Both index funds and ETFs are equally safe, there is no distinction between which is safer.

Some of the best index funds are-

One cannot invest in ETFs through SIP, it is a close-ended fund and the value of ETF changes like stocks.

Expert Opinion

Exchange-Traded Funds (ETFs) and Index Funds serve the same investment objectives. If you have a Demat and share trading account, you can invest in Exchange Traded Funds (ETFs) if you prefer lower expense ratios. However, if you do not have a Demat and share trading account then you can achieve the same objectives by investing in index funds like any other open-ended mutual fund scheme.