Retirement planning is a complex but a very important topic, especially in today’s context as our country is going through a process of economic and social transformation. Some of these changes are:-

- Shift from joint families to nuclear families

- Children are migrating to other cities for employment

- Higher inflation levels

- Increased life expectancy

- Rising cost of healthcare

These changes and probably others in the future, make it imperative for us to plan for retirement early in our working lives. It is important that we understand the fundamental goal of retirement planning, which is to achieve financial independence in your retirement years. The other important retirement planning goal is to be able to maintain your current lifestyle even during your retirement years. However, in our country retirement planning is not given the due importance that it deserves. Also unfortunately, the universe of retirement planning options in the market in India is also very limited. Traditionally employee provident fund, public provident fund and life insurance policies have been the investment options commonly associated with retirement planning in India. All these investments are seen as risk free investment, and retirement planning as such in India is usually associated with these investments. These investments also enjoy tax saving benefit under Section 80C of the Income Tax. However, there are two other eligible investment options under Section 80C, which are more suited to retirement planning especially for young investors. These are the National Pension Scheme and Equity Linked Savings Scheme (ELSS). In this blog we will discuss the best retirement planning investments for young investors.

At the outset, we should discuss the objective of retirement planning. The fundamental goal of retirement planning is to achieve financial independence in your retirement years and to be able to maintain your current lifestyle after retirement. If you save a portion of your income and invest it, you should be able to accumulate your retirement corpus. However, we should understand the difference between savings and investing.

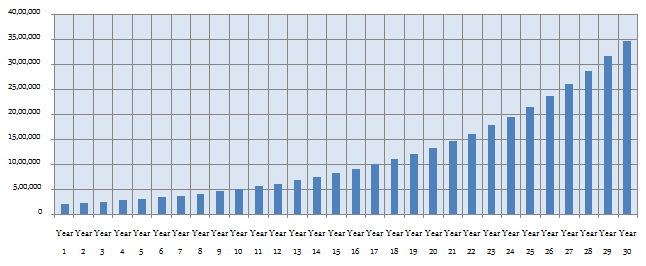

While many of us do a good job with savings, unfortunately, we do not do a good job with investments. Let us walk through an example with numbers and hopefully you will understand, it is not as easy as it sounds. Let us assume you are 30 years old. You will retire at 60. Your current income is र 10 lacs per year. Let us assume that, your basic salary is 50% of your gross salary (it is usually in the 40% to 50% range). You contribute 12% of your basic salary to Employee Provident Fund. Your employer makes a matching contribution. In addition, let us assume you will save another 10% of your gross income for retirement planning. Let us further assume that you get a salary increment of 10% every year. The chart below shows how much you will save till your retirement.

If you get a return of 8% (compounded) on your savings, you will accumulate a corpus of र 8.1 crores at retirement. It is impressive so far. Let us now see, how long this amount will last after your retirement. Here we come back to one of the key objectives of retirement planning, which is to maintain a certain lifestyle. Let us assume you want to maintain the lifestyle you had towards the end of your working career. Assuming you get 8% pre tax returns on your retirement savings, your corpus will last 10 years at best. It does not look that impressive any more. But it is about to get worse, once we factor the ugly 9 letter word, inflation. Factor in 5% inflation and your corpus will last only about 7 – 8 years. Retired lives can be as long as 25 to 30 years. In this example, you are losing your financial independence, even before you reach the half way stage of your retired life.

You can save more towards retirement. However, you will agree with me that it is easier said than done. Inflation and taxes take out big part of our income. Home loan EMIs take out another big chunk. Then you have other investment goals as well, like children’s education, marriage etc. Saving more towards retirement is, therefore, not always feasible. The solution lies in getting better returns on your retirement planning investment and that is the crux of this blog. If instead of 8% returns you get 15% returns, your retirement corpus will last for around 20 years instead of 7 – 8 years. Is it possible to get 15% return on your investment? The answer is yes. Let us review the various retirement planning investment options under Section 80C.

Voluntary Provident Fund: You can make voluntary contribution to your provident fund account. You will get interest of 8.5% on your contribution. You cannot contribute till your retirement. However, you can get loans under some circumstances. The maturity proceeds are tax exempt.

Public Provident Fund (PPF): You can make deposits to your PPF account. PPF interest rate is currently 8.7%. However, the rates may vary since it is being pegged to 10 year Government Bond yield. The tenure of this instrument is 15 years, and is extendable in blocks of 5 years. Withdrawals not exceeding 50% of 4th year balance are permitted after a lock-in period of 7 years. PPF also offers loan facilities. The maximum and investment under PPF is र 1.5 lac and Rs 500/-. The maturity proceeds are tax exempt.

Life Insurance Policies: Life insurance premiums are eligible for tax savings under Section 80C. You get life cover and survival benefits on completion of the policy term. There are two kinds of life insurance plans, traditional plans and unit linked plans. Traditional endowment plans have historically given 6 – 7% internal rate of return. Unit linked plans are market linked instruments. In addition to providing life cover, a portion of your premiums are invested in purchasing units of a fund of your choice. On an average equity oriented ULIP funds have given 15 – 18% annualized returns over a 10 year investment horizon. However, your effective returns can be much lower because of your premium will go towards the mortality charges (life cover) and various fees like premium allocation, policy administration, fund management etc. These fees are deducted from your premium and only the balance amount is invested in the units of the fund. In the initial years of your policy life as much as 10% of your premium can go towards these fees and not be invested to buy units.

National Pension Scheme: National Pension Scheme (NPS) is open to all citizens who want to invest for retirement. It is a defined contribution pension system where the investor makes contributions on a regular basis. It is a market-linked product which does not guarantee returns. It is low cost product (fund management charges are capped at 25 basis points). To invest in this scheme you need to apply for a permanent retirement account number (PRAN), through point of presence service providers. Once you receive you PRAN card, you can invest in a fund of your choice. There are two types of NPS accounts. Tier 1 account is mandatory and qualifies for Section 80C tax savings. There is a minimum contribution amount for Tier 1 accounts. This account does not allow premature withdrawal. Tier 2 account allows premature withdrawals under certain circumstances and does not qualify for 80C tax savings. In the 2015 Budget an additional tax deduction of र 50,000 has been allowed for NPS contributions under Section 80CCD. This is over and above the र 150,000 tax savings allowed under Section 80C. The average 3 year annualized returns of Tier 1 and Tier 2 equity plans is around 15%, whereas the average 5 year annualized returns is around 8%. The maturity amount of NPS is not tax free. We will discuss this in more details later.

Equity Linked Savings Scheme (ELSS): ELSS is a mutual fund scheme that qualifies for tax savings under Section 80C up to a limit of र 150,000. An ELSS is essentially a diversified equity scheme with a lock in period of three years from the date of the investment. Capital gains in ELSS are tax exempt. Dividends paid by ELSS are also tax free. If you invest in an ELSS through a systematic investment plan (SIP), each investment will be locked in for 3 years from their respective investment dates. Compared to other retirement planning investments under Section 80C ELSS offers higher liquidity and potentially superior post tax returns. However, as with all mutual fund investments ELSS are also subject to market risk. ELSS funds have given an average 20% trailing annualized returns over the last 3 years, 10% annualized returns over the last 5 years and 12% annualized returns over the last 10 years. Compared to NPS, ELSS funds on an average have given higher returns. The difference is even bigger if you compare the performance of top performing ELSS funds with their NPS counterparts. While the top performing NPS fund has given 15.7% trailing 3 years annualized returns, the top performing ELSS has given over 30% trailing 3 years annualized returns. A major advantage which ELSS enjoys over NPS is the tax treatment on maturity. While capital gains in ELSS are tax free, NPS maturity amount is taxable on withdrawal. The other problem is that, under the current rules, 40% of the NPS maturity amount must compulsorily be used to purchase annuities and the annuity income is taxable. There are also limits on equity allocations in NPS, which younger investors may find too conservative relative to their risk profile.

How can ELSS help you create a retirement corpus?

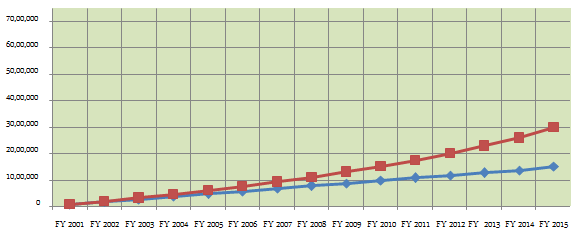

Let us see how much wealth could have created in the last 15 years from FY 2001 to FY 2015 by investing in ELSS versus a risk free investment like PPF. For our analysis we have assumed an annual investment of र 70,000 in FY 2000 – 2001, र 100,000 from FY 2001 – 2002 to FY 2013 – 2014 and र 150,000 in FY 2014 – 2015, as per Section 80C limits for the respective years. Let us first see how much maturity amount one would have accumulated in the last 15 years by investing up to the maximum 80C investment limit in PPF. The chart below shows the cumulative deposit amount and value of the investment in PPF.

The blue line shows the cumulative deposits made by the investor in his or her PPF account every year. The total deposit made by the investor is र 15,20,000 (र 15.2 lacs) over the duration of the PPF. The red line shows the value of the PPF account, inclusive of accrued interest. The maturity amount of the investor is about र 29,82,000 (around र 29.8 lacs).

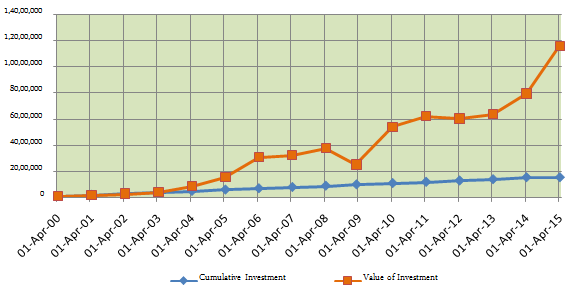

Let us now see how much corpus would an investor have accumulated by investing up to the maximum 80C investment limit in ELSS. In this example, we have chosen an average ELSS fund which completed 15 years. The chart below shows the cumulative investment amount and value of the investment in ELSS.

The blue line shows the cumulative deposits made by the investor in the ELSS fund every year. The total investment made by the investor from 2000 – 2015, is र 15,20,000 (र 15.2 lacs), the same amount deposited in PPF in the previous example. The orange line shows the value of the ELSS investment based on prevailing NAVs. As we can see from the chart above, the ELSS returns are of a very different order of magnitude compared to PPF. In fact, the current value of the first two ELSS investments made in 2000 and 2001 itself is much more than the total maturity amount accumulated in PPF in the previous example. The value of the ELSS investment as on Apr 2, 2015 is over र 1.15 crores, nearly four times the PPF maturity amount. The internal rate of return (IRR) is well over 20%.

Is it possible to get similar returns from other investment options?

Historically, we have seen that equity as an asset class has given the highest returns over a long investment horizon. You could get returns similar to what ELSS has given by investing in diversified equity mutual funds. However, by investing in ELSS you can get the added benefit of tax savings under Section 80C. If you have invested the maximum amount allowed under Section 80C in ELSS, then you can invest in diversified equity funds or you can continue to invest in ELSS.

Conclusion

In this article we have reviewed various retirement planning investment options. For young investor’s equities should form a major portion of your asset allocation. We have seen that ELSS is one of the best tax saving investments for investors looking to create wealth in the long term. As such ELSS is one of the best investment options for retirement planning.

(First published in Advisorkhoj.com)

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.