From Director’s Desk | Anirudh Dar

“mutual funds sahi hai” is something we constantly readin print media and seen on television and while that may be true in parts, the bigger question is “KAUNSA mutual fund sahi hai...?” Think about this. Can every consumer product available in the market be right for every audience? Surely no. Which is why there are variants available - soap for dry skin, for oily skin, for balanced skin, and so on and so forth. Mutual funds are also consumer products and we need to be amply sure which one works for what purpose.

But let us first understand the three stages in everyone's investment journeys.

- Accumulation

- Growth

- Withdrawal

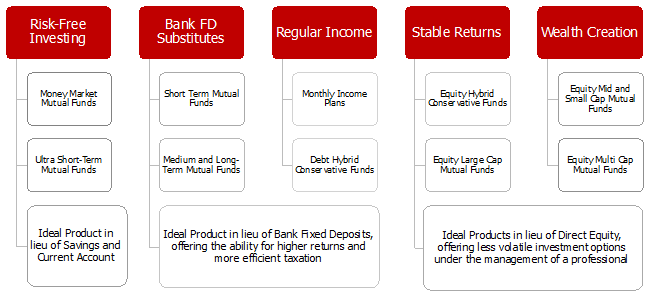

For this, we need to create, protect and preserve our wealth. Interestingly, there is an investment idea for each stage of our investment journey. This table here will help you determine that.

Looking at this table above, it is fairly apparent that if you want to create wealth, then debt mutual funds, income plans or even conservative hybrid funds may not be the most preferred route to take. Yes, you may opt for those if you are looking to conserve your capital or looking to invest with a view to just about beat inflation, if that too.

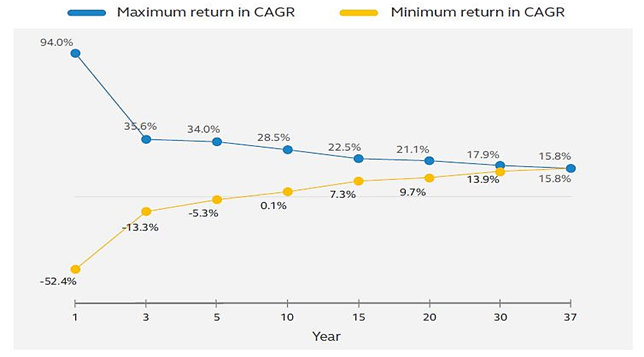

In order to create wealth, you would need to take a little more risk which would mean investing in aggressive mid, small or perhaps even multi-cap funds. Now while these funds do come with a substantial downside risk, meaning a risk to your principal, if held for a period of at least 60 months and beyond, the downside risk decreases significantly. This table below should iterate that point clearly.

If you plan on investing in equity mutual funds for a period of 12 months, in extraordinary years like 2014 you could have had the opportunity to have doubled your money. But for every 2014, there is also a 2008 where you would have effectively halved your investments. For an average holding period of 60 months and beyond the maximum-minimum range for returns is between 34% to -5% on a CAGR basis. The volatility eases out as you are closer to the 8-10 year holding mark, where historically, it has been proven conclusively that even in the high risk investments like mid,small and multi-cap mutual funds, you would be extremely unlucky to lose money. On the other hand, you could expect handsome returns in the range of mid double digit if investments are held for 8-10 years.

The best way to corelate risk, reward and time taken to double investments is the classic rule of 72. It helps people in figuring out how much risk they can take and on the basis of that risk, how much time it would take for them to double their money. For this, all we need to do is divide 72 by the expected rate of return. The answer would be the time it would take for that investment to double. In this formula, it would be simple to figure out the risk. The lower the divisor, the lower the risk and hence the longer it would take for your money to double. On the flip side, the higher the divisor, the higher the risk and hence lower the time taken for your investments to double.

It is always our dream to make money and create wealth and there are some simple steps in order to do so. First, an understanding of your risk is paramount. Secondly, everything needs time and so do investments. Reducing your investing horizon and taking excessive risk will always result in losing money. You need to appropriately balance your expectations and invest in the products most suited to you.