Mutual Funds and ULIP are two popular modes of investment in India. Mutual funds are subject to market risk whereas Unit Linked Insurance Plans (ULIPs) are a combination of life insurance and investment commodities. Investors are often confused between these two investments, as both generate good returns on long-term basis.

What is a mutual fund?

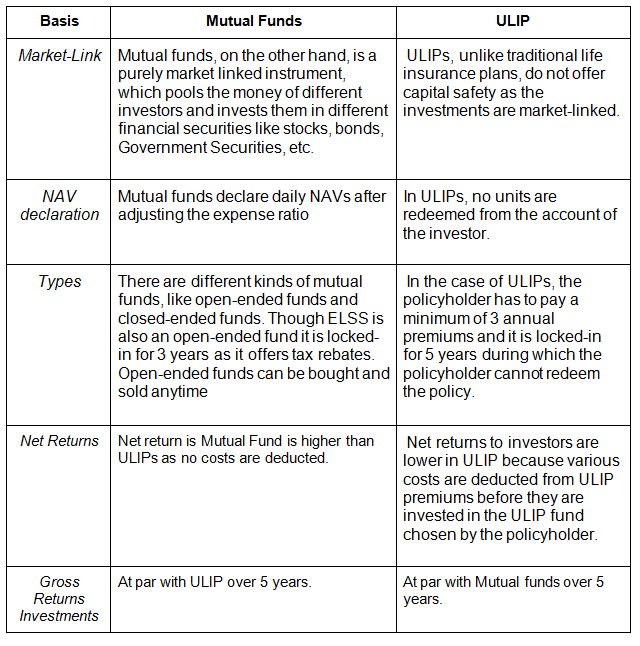

A mutual fund is a purely market linked instrument, which pools the money of different investors and invests them in different financial securities like stocks, bonds, money market instruments, and Government Securities, etc. Each investor in a mutual fund owns units of the fund proportionate to his investments, which represents a portion of the total holdings of the mutual fund.

What is ULIP?

Unit Linked Insurance Plans (ULIPs) are combined life insurance-cum-investment products. Unlike traditional insurance plans like endowment policy, money back plans, pension plans, and term insurance plans, etc., ULIPs are market-linked products and have the potential to deliver higher returns compared to traditional life insurance plans. ULIPs invest in different market-linked investments and offer a basket of products like equity funds, balanced funds, and debt funds. The policyholder can choose a fund based on his/her risk appetite.

Mutual Funds vs ULIP

People Often Ask

- Is ULIP better than mutual fund?

The primary benefit of ULIP over mutual funds is that ULIPs offer life cover, that is missing in mutual funds. The life cover comes in handy in cases of the untimely demise of the holder. - Which ULIP plan is best?

Some of the best ULIP plans are

- HDFC Life Pro-Growth Plus.

- Kotak Life Insurance (Kotak Platinum ULIP)

- Which is the best mutual fund in India?

Some of the best mutual funds in India are

- Is ULIP safe?

Yes, ULIP is safe and it is an apt investment method for those who want to invest for a long time period. It acts as an investment and insurance and gives a dual benefit of saving and protection. - Is ULIP tax free?

Premiums paid for ULIPs are eligible for tax deduction under Section 80C of the Income Tax Act, 1961, but the total amount received on the maturity of ULIP plan is eligible for tax exemption.

Expert Opinion

In our opinion, investors should not mix investments and insurance. For wealth creation and other investments needs, an investor should invest in mutual funds which offer investment solution for 1 day to entire life. One should consider life insurance for pure protection purposes and should not look for return from life insurance plans. For protecting life, term insurance plans are the best option.