ARTI ARORA CFP CM | HEAD FINANCIAL PLANNER

Health and wealth; these are the two most important parameters for one to look at, maintain & take care of at all times. Their importance can be over emphasized.

The pandemic times continuing since last 15 months and only having worsened this year have brought forth an element of uncertainty and a fear of the unknown in each one of us. There is no one not impacted in whichever way, big or small. This second wave has hit one and all; old & young, single & married, physically fit & unfit; it hasn’t spared anyone. There is so much pain and grief everywhere but life for those left behind has to go on.

In times like these and otherwise too, planning our way forward is the best way to address most, if not all concerns related to money matters.

So, while we do hear that there is life beyond planning and there really is, planning just simplifies it beyond one can imagine.

In financial parlance, what does planning mean? Is it same as financial planning? Is it related to aligning your investments to goals? Has it got to do something with being adequately insured?

Well, financial planning is deep, comprehensive and all-encompassing but what we wish to convey through this blog is a very limited but pivotal part of planning that holds more relevance today than it ever had.

Tomorrow has always been uncertain but with Corona, this uncertainty has been taken to just another level as this virus is affecting everyone irrespective of your age, gender, eating habits, immunity and any other factor that may come to your mind.

In such a scenario, the role of your financial planner / advisor has become even more pertinent and so has the onus on you to share with your family all your financial details including assets; financial & non-financial, liabilities, cash flows, provisions, bank accounts, passwords, locker information, nominations, financial advisor name & number and just everything about your finances. Introducing your financial planner / advisor to your family is another important to-do for you.

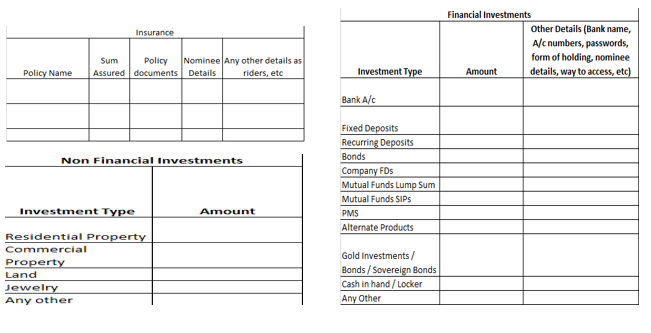

Above are sample spreadsheets for sheer purpose of illustration that one can work around and make sure every financial detail, big or small is documented. The access of this file ideally should remain with the primary family members including children who have attained majority.

This master file must also record all source destinations from where receipts, documents, passwords and any other vital financial detail can be sourced from.

Wills and estate planning typically come to our mind only after having attained that senior citizen title. In such a scenario, we believe and profess the need for consolidating all financial details in one place and sharing it with our immediate family so as to smoothen things out in case an eventuality strikes. This step of financial hygiene must be followed at all times and by everyone who has anyone financially dependent on them.

If any of you want us to help you or assist you with exact spreadsheet formats, you can write in to us just as Harsh & Shalini did and we would be happy to assist you.