Arti Arora, CFP | Head Financial Planner

Paying a part of your hard-earned money as taxes pains but we as responsible citizens of the country have to accept this outage. The point of respite is that our taxation system, the annual budget and some broad government policy decisions allow us ways to legally minimize this annual outflow.

If we pay attention to some of these measures in the beginning of the financial year itself, we can find efficient means to not only save tax but also be en route to wealth creation which is a common financial objective for every one of us.

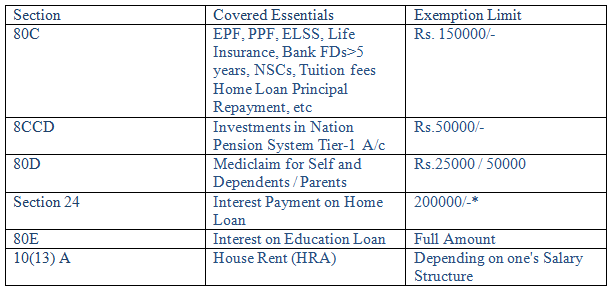

Let us bring forth and for those of you who are already aware, revisit some of the common tax saving sections and rules under the Income Tax Act as understanding of these is a precursor to prudent tax planning -

This list is of course not exhaustive but does give a good view of how tax planning is not and should not be taken as a standalone exercise. Investment Planning, Risk Cover Protection / Planning, Retirement Planning, Goal Planning & Cash Flow Planning are all connected with it as can be seen in the ‘Covered Essentials’ head and by prioritizing one’s needs, one can actually do a much better job in planning their financial life as a whole.

The above clearly illustrates that Tax Planning is an integral part of an individual’s overall financial planning. An integrated approach helps in arriving at optimal solutions by giving a crystal clear view of one’s cash flow situation so that goal funding plans can be created or altered accordingly.

Every year, some new sections get added to the budget to promote different developmental plans that the government has. For example; Section 80EEA was introduced in last year’s budget and has been extended to this year too where to promote ‘Housing for All’, the government allowed additional tax deduction on interest payment of Rs.1.5 lac over and above the one permitted under Section 24 provided the value of house purchased did not exceed Rs. 45 lakhs.

Likewise, there are various opportunities that one can explore in lawful means to save on their taxes and also provide for their various financial needs.

Consulting an expert, a Certified Professional who has the requisite knowledge and who can render holistic advice is always a great step forward following which there can never be looking back.