From Director's Desk | Anirudh Dar

About a year and a half ago, everything seemed right in the equity and debt markets; the 10-year G-Sec yields were in the range of 6.50-6.75%, lending rates were at 8.5-9.0% & deposit rates were between 7.5-8.25% per annum, as offered by scheduled commercial banks. These rates were even significantly higher by more than 100-150bps in case of select corporate fixed deposits. Suddenly a series of financial crises hit upon us – to name a few - IL&FS failed, DHFL collapsed and we saw high-profile defaults in the corporate debt & bond markets with AAA-rated paper like Essel, Reliance Home Finance, Altico Capital and most notably, Vodafone defaulting on interest payments, leading directly to 6 debt fund schemes managing more than Rs 27000 crore wound up, leaving investors in shock. Earlier this year, equity markets embarked on possibly one of the steepest falls in recorded history and within a month, fell from 42000 to 26000 points. Fortunately, reducing COVID cases, the hope of a possible vaccine, a change of regime in the US and record low interest rates globally signaled a shift to a risk-on approach for equity markets. Reducing interest rates and a gush of liquidity has taken our indices to their life highs and this is great news for the equity market enthusiasts.

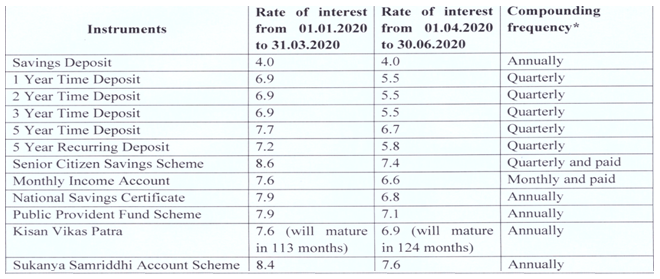

On the other hand, the RBI started reducing the repo and the reverse repo rates in the last 18 months or so, and this has resulted in steep interest rate cuts on all small saving schemes issued by Govt of anything between 80-140bps. The most endeared Public Provident Fund rate came down from 8.5% to 7.1% per annum, its lowest rate in more than 2 decades. Taking a cue from the RBI cuts, banks rushed to cut their fixed deposit rates to under 5% & saving rates to about 2% per annum. Here are the rates for all the savings schemes sponsored by the Government, in case you missed seeing them:

Despite these cuts, and while the PPF may remain a safe investment option for a certain section of the ultra-conservative investors, I want to draw your attention to another instrument, which not only offers a guaranteed yield, but life insurance too.

In this blog, I will discuss one specific product type, which is suddenly looking attractive in these uncertain times of dwindling savings and interest rates. The answer could be Endowment Plans. Many wealth managers are recommending non-market linked endowment plans to their clients and investors alike. Some of these plans are currently offering guaranteed yields of anything in between 5.75% - 6.75%. Here are some main advantages of endowment plans:

- Guaranteed benefits – So you can be rest assured of the returns

- Tax benefits – You may be eligible for tax benefits as per prevailing tax laws

- Flexibility – Guaranteed benefits as a lump sum or as regular income

- Life-long Income option – Guaranteed income till age 99 years

- Long Term Income option – Guaranteed Income for a fixed term of 25 to 30 years

Most investors and clients still compare this product above with PPF and argue on the benefits of the latter, to which I always say that there is place for two quasi-equivalent products in one’s individual portfolios. Despite that, there are some stark differences:

- PPF has an annual investment limit of Rs 1.50 lac - meaning that you may never be able to accumulate enough for it to be the only saving instrument for your retirement.

- From an interest rate of 12% in the year 2000 to the current 7.10% in 2020 – that is a 5% absolute cut in two decades. For those actively saving in PPF, where do you think, this rate would be in the next two decades?

- The current 10-year Government bond yield in India hovers between 5.75% and 5.90% which is sovereign in nature. The current 30-year US Treasury yield is at 1.26%. In Germany, the strongest EU country, the 10-year Government bond yield currently stands at -0.434%. Yes, that’s a minus 0.434%.

- With PPF as well all other Government led savings interest rates linked to its bond yields, it is only a matter of time, when this fall too.

- For those investing in Fixed Deposits, the biggest risk for them is the ‘reinvestment rate risk’, meaning that an FD booked today at 6% may renew only at a lower rate of 5% at the end of one year in a falling interest rate scenario as we are faced with today.

- The current yields on certain guaranteed endowment plans continue to be more than 6% which are excellent given the times we are in currently.

Given these comparisons, I hope this blog will give you an alternate perspective into a product that not only offers you tax-free guaranteed benefits – but interest rates that will not change once you have opted for it, unlike all others.