As we all know, nowadays SIP is one of the popular modes of investment. It’s the EMI we pay to ourselves. In mutual funds, SIP is investing a fixed amount of money in the opted fund regularly. It gives the opportunity of rupee cost averaging and neutralizes the volatility of the market. It makes it convenient for investors to invest in equity or debt funds even with a small amount. Now, like trading, investing mutual funds even via SIP has become fairly easy and hassle free. In just a few simple steps, one can start SIP online. 1. To opt for the mutual fund to invest into 2. The next step is to pay. 3. Third step is to add mandates so that monthly SIP can be auto-debited from the account of the investor. Thus, do your One Time Mandate (OTM).

What is One Time Mandate (OTM) in SIP?

- Today, e-wallets are a popular mode of the mandate. You provide funds from your bank account and then that money can be used to transact without going through any payment gateway. One Time Mandate (OTM) is suggested as an e-wallet to invest in.

- It’s a one-time registration process that will allow investors to conveniently undertake lump sum / SIP investments in both, offline and online mode.

- Once you register this mandate, you will entitle the bank (which is registered with your Mutual Fund portfolio) to debit a definite amount on a selected date, towards your selected investment scheme. This one-time mandate can either be mandated for a fixed tenure (Say, 5 years) or can remain valid until and unless investors cancel it.

- Once the OTM is registered with the relevant bank, it enables you to smooth transactions, with just a simple tick in the OTM box either through online or offline Form. It saves the investor from the trouble of affixing a cheque or routing the payment through a payment gateway, remembering your Debit card / net banking details, etc. every time while making a SIP payment. Thus, OTM in SIP is a convenient option in such cases.

Steps of doing OTM on our website-

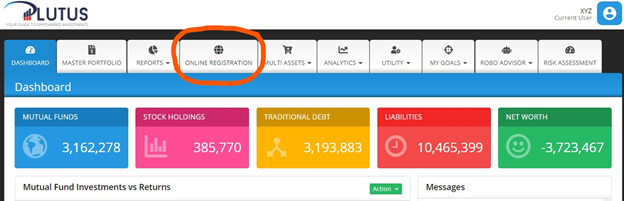

- Click on Sign up to create a new account, if already created then log in to your account.

- Once your dashboard appears, click on the head ‘Online Registration’. Fill in all the details in the form, upload a canceled cheque and signatures and submit it and authenticate it.

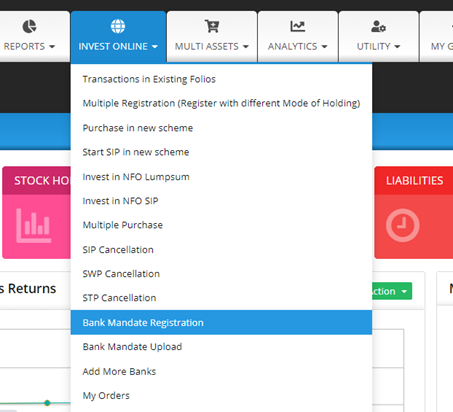

- After online registration is done, the Online registration head changes to ‘Invest Online’. Under this column click on ‘Bank Mandate Registration’

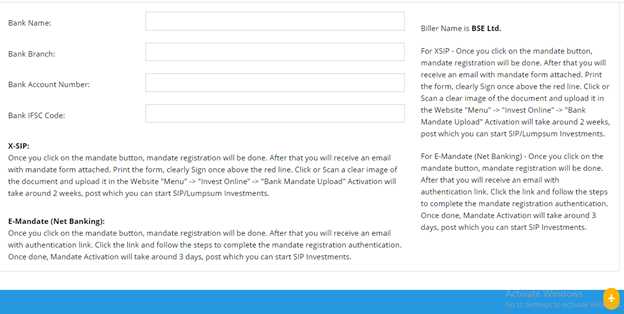

- Fill up your bank details and submit it.

- Once you click on the mandate button, mandate registration will be done. After that, you will receive an email with an authentication link. Click the link and follow the steps to complete the mandate registration authentication. Once done, Mandate Activation will take around 3 days, post which you can start SIP Investments.

Conclusion

Therefore, this one-time mandate option is a facility that has reduced a lot of paperwork, time, and documentation which enables the investors to make investment hassle-free. Thus, after the feature of OTM in SIP, these mutual fund investments are being made more confidently and seamlessly by the investors.

People often ask

- Is OTM mandatory for SIP?

- What is the maximum amount in OTM?

- Which is the best date for SIP?

- Is Weekly sip better than monthly SIP?

- Can I stop sip anytime?

- Which is a better mutual fund or SIP?

No, OTM is not mandatory for SIP, you can set up an auto-debit option from your account and set up the debit date.

The minimum amount of OTM is 25,000 but there is no upper limit to OTM.

The best date for SIP is the 10th of every month as per the trend and experts. However, people also invest in the dates like the 5th, 10th,15th, and 25th of every month. Date for SIP investment depends upon your convenience on which date you want to invest.

No, weekly SIP is not better than a monthly SIP as in the long run, monthly SIP offers more returns on investment. If you are looking for short-term investments then you should opt for the weekly SIP.

Yes, you can stop SIP anytime as per your wish.

SIP or mutual funds cannot be compared as SIP is a part of mutual funds and hence one cannot decide which one is better.