NPS v/s Mutual Fund is a comparison most investors tend to analyze when deciding about their investments specifically linked to their retirement planning goal. It is obvious for such comparisons to take place because traditionally mutual funds were the preferred investment for retirement planning apart from the traditional options of EPF, PPF, etc.

With the introduction of NPS as a specialized retirement planning tool, there is diversity offered to us as investors to pick the most suitable option for ourselves.

Before discussing the case of NPS v/s Mutual Fund, let us study both these product types in greater detail so one can make an informed choice and does a rational allocation of funds towards meeting their respective investment objectives.

Mutual Funds are a pool of resources where lakhs of investors pool their money for professional management to earn above-average returns in line with the plan or scheme’s investment objectives. The common fund or pool is managed by a fund manager who has the necessary expertise and experience for efficient deployment of the investor funds and who seeks to generate returns on the same.

NPS or National Pension System on the other hand is an initiative undertaken by the government as a voluntary defined contribution pension system that can be opted for by anyone irrespective of him/her being a government employee. This scheme is open for investment to the citizens of India at large. Any individual who is a citizen of India and is in the age range of 18-65 years can join NPS.

Initially, in the year 2004, NPS was introduced only for Central Government Employees (except for the armed forces) but then a few years later, in 2009, it was made available to all the Indian citizens at large.

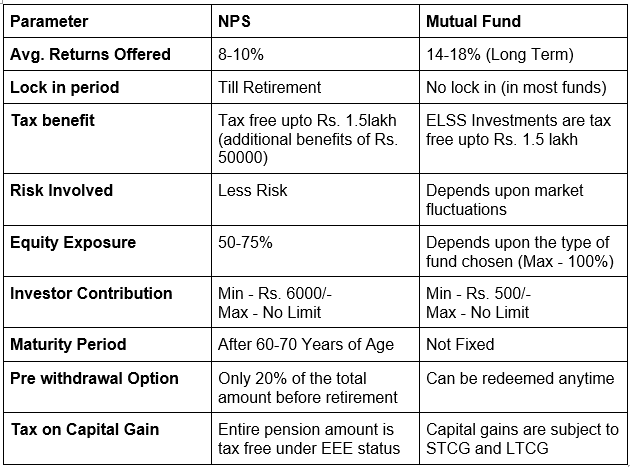

Difference Between NPS vs Mutual Fund

How does NPS work?

There are two kinds of accounts in NPS – Tier 1 & Tier 2. Tier 1 a/c is the main pension account that has to be opened mandatorily while tier 2 a/c is optional and can only be opened once tier 1 a/c has been opened.

When an investor opens the tier 1 a/c in NPS, he has the following choices to make –

- Choice of the Pension Fund Manager (PFM) – please note that past performance is not an indicator of the future. There are 8 PFMs including SBI, ICICI, UTI, HDFC & Kotak, DSP, Birla & LIC that one may choose from

- Having decided on the PFM, the next choice to be made is the Asset Allocation across Equity (E), Corporate Debt (C) & Government Bonds (G). One can choose to invest a maximum of up to 50% in equity and the balance can be divided across Corporate & Government Papers.

- In this choice of allocation, there is another choice that an investor can make. A choice between Auto & Active Mode of Investment. In the former, based on the choice the investor makes, the allocation keeps moving across E, C & G automatically in a pre-decided mode based on age bands decided by the government. In the latter, however, one has to choose their asset allocation subject to the maximum allowable limit of 50% inequities.

- An Investor can change either of a, b & c depending on their preference at any point in time. There is no rigidity in choices being made available to the investors.

- Service requests for these can either be routed through the PoP-SP (Point of presence- Service Providers) or the ends mode if the investment is made online.

- The PoP-SPs were set up to expand the reach of NPS as a means to earn reasonable market returns over a longish period to be able to earn a regular income in retirement years. The investment in NPS can be done online too with much ease.

- 40% of the amount accumulated by the age of 60 can be redeemed in a lump sum from NPS and the balance 60% has to be used to buy an annuity plan to meet the investment objective of regular income in retirement years.

- The NPS comes in the EET regime where contributions up to 50000 in any financial year are tax exempt u/s 80CCF, the investment remains tax-exempt during the tenure and becomes taxable on maturity to the extent of lump sum drawn out. The amount used to buy the annuity plan is not taxed at the outset but the pension that comes from it is subject to taxation.

Understanding the above structure of NPS, some important points can be inferred in the NPS vs Mutual Fund subject.

NPS predominantly is a retirement planning tool and cannot be directed towards funding other goals whereas mutual funds are a more broad-based investment option that can be linked to any financial goal an individual may have.

While NPS is tax-efficient as it falls in the EET regime, the same is not the case with mutual funds except for the ELSS schemes which come with tax benefits.

The range of investment options across the different asset classes is much more exhaustive in Mutual funds vis-à-vis NPS. Not only this, an investor with an aggressive risk profile can take up to 100% exposure inequities for their long term goals while this percentage is limited to 50% in NPS which makes it a more preferred investment avenue for conservative to balanced investor profiles.

People often ask

- Is NPS Tier 2 better than mutual funds?

- What are the disadvantages of NPS?

- Which is a better NPS Tier 1 or Tier 2?

- Is it better to buy mutual funds directly?

- Are mutual funds safe in a recession?

- Which mutual fund gives the highest return?

NPS Tier 2 has outperformed mutual funds by 11% as per the reports, but all NPS Tier 2 is not suitable for all citizen model plans and all mutual funds do not qualify for tax deductions.

NPS offers fewer incentives for government employees as compared to other incentive plans. It also has a withdrawal limit that is far less than the other pension plans.

NPS Tier 2 is a more flexible and updated version of NPS tier 1 that allows an increment in withdrawal limit. Tier 1 is meant for retirement plan and Tier 2

It is better to buy mutual funds directly only if you have knowledge related to that. Otherwise you can consider www.meetplutus.com

Since mutual funds are subject to market risk, mutual funds are not safe in recession. However, if you are planning to invest in mutual funds, then you should invest during the recession at lower rates to access the benefits later.

5 years SIP plans usually give the highest returns, the companies with the best 5 years SIP plans are SBI Bluechip fund, Edelweiss Large Cap Fund

Conclusion

To sum it up, NPS vs Mutual Fund cannot have a definitive conclusion. Both the product options have their own merits and limitations too. Based on an investor’s financial goals and risk-taking capacity, one can decide on the investment avenue to be chosen. NPS as a part of an investor’s retirement plan does make a good fit but its alignment to other financial goals looks difficult. Diversification remains the key and by investing across products, one can spread the risk and optimize returns too if the investment decisions are taken with a keen eye.

Last but not the least, as we look at NPS vs Mutual Funds, one can at best compare NPS with Balanced and debt-oriented mutual funds because of the restricted allowed exposure to equities. Comparing apples with oranges does not deem fit just as comparing NPS with equity-oriented mutual funds. Having said that, Retirement Planning with part of funds allocated to NPS is a viable option that one can consider at any point in time in the overall construct of one’s financial plan but it cannot be a substitute for mutual funds especially in the longer run.